Private Limited Company vs LLP for Investors

Private Limited Company vs LLP: Which One Attracts Investors More?

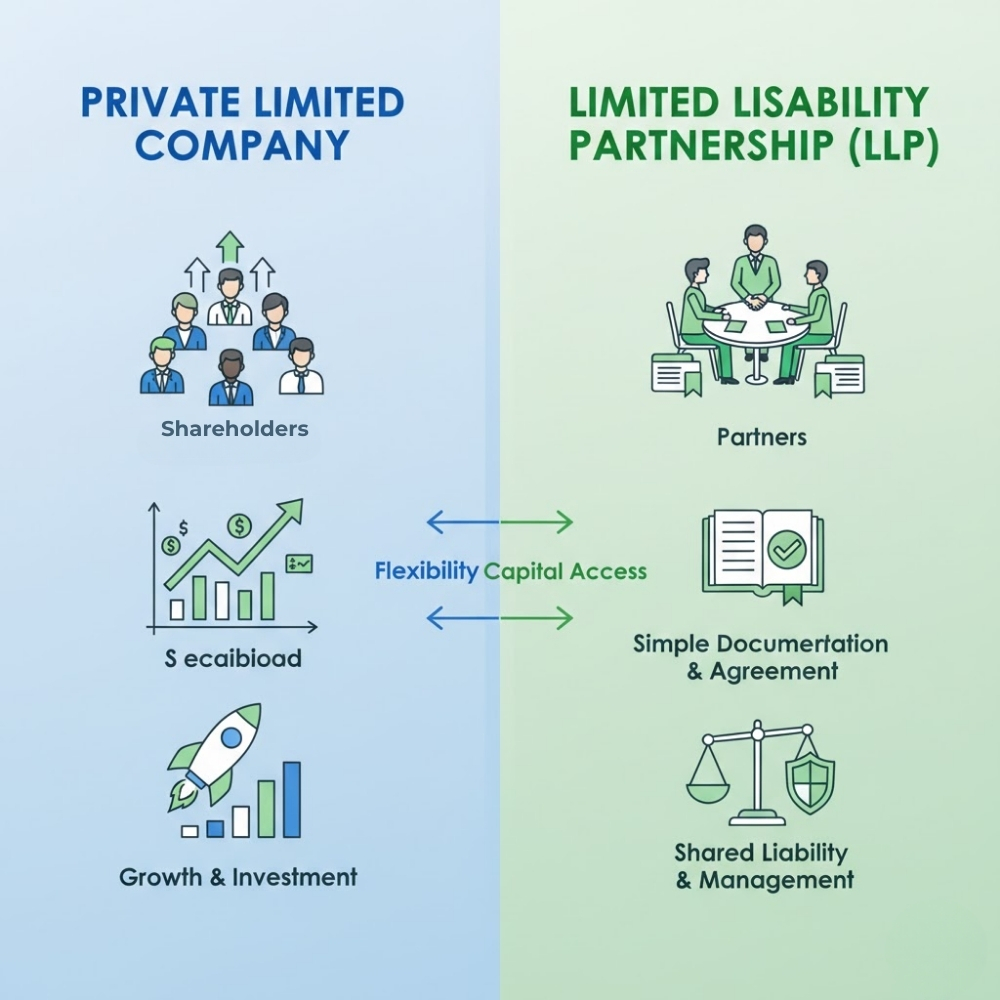

Starting a business is exciting. Choosing the right business structure is even more important. Many business owners ask one big question before they grow. They want to know what structure investors like more. This is why the topic private limited company vs LLP for investors is so important.

Investors do not only look at ideas. They look at safety, structure, and future growth. The type of company you choose plays a big role in investor trust. Let us talk in simple words about private limited companies and LLPs and how investors see them.

Why Investors Care About Business Structure

Investors want clarity. They want to know where their money is going. They want to know how ownership works and how safe their investment is.

When investors study a business, structure is one of the first things they check. This is why private limited company vs LLP for investors becomes a serious discussion during funding talks.

Understanding a Private Limited Company

A private limited company is a popular choice for growing businesses. It has shareholders and directors. Ownership is divided into shares.

This structure gives clear control and clear records. Everything is written and tracked. For investors, this feels safe and familiar. This is one reason why private limited company vs LLP for investors often leans towards private limited companies.

Understanding an LLP Structure

An LLP is a mix of partnership and company. It has partners instead of shareholders. Profit sharing is decided by agreement.

LLPs are simple to manage. Many small businesses like them because compliance feels lighter. But when it comes to investors, LLPs raise questions. This difference is central to the private limited company vs LLP for investors debate.

Why Investors Prefer Private Limited Companies

Most investors prefer private limited companies because of clear ownership. Shares can be easily issued, transferred, and valued.

Investors like knowing how much they own. They like voting rights and legal protection. In the private limited company vs LLP for investors comparison, this clarity gives private limited companies an edge.

Funding and Shareholding Flexibility

Funding works smoothly in private limited companies. New shares can be issued to investors. Ownership can change without disturbing operations.

In LLPs, bringing in investors is more complex. Profit sharing must be changed. Agreements must be rewritten. This makes investors uncomfortable. This is why private limited company vs LLP for investors usually favors private limited companies.

Exit Options Matter to Investors

Investors always think about exit. They want to know how they will leave in the future.

Private limited companies offer better exit options. Shares can be sold or transferred. Mergers and acquisitions are easier. LLP exits are not as smooth. This makes a big difference in private limited company vs LLP for investors decisions.

Compliance and Transparency Build Trust

Private limited companies follow strict compliance rules. Financial statements, ROC filings, and audits are mandatory.

This creates transparency. Investors trust numbers that are verified. LLPs have fewer requirements. While this helps owners, it reduces investor confidence. Transparency is a key factor in private limited company vs LLP for investors.

Valuation Is Easier in Private Limited Companies

Investors want to know the value of a business. Valuation is easier when shares exist.

Private limited companies can be valued based on shareholding and growth. LLP valuation is more complex and less standard. This creates confusion. In the private limited company vs LLP for investors comparison, easy valuation matters a lot.

Investor Mindset Is Built Around Companies

Most investors are used to investing in companies, not partnerships. Their systems, documents, and experience are built around private limited companies.

LLPs feel unfamiliar to many investors. This mental comfort plays a big role in private limited company vs LLP for investors preferences.

LLPs Are Better for Lifestyle Businesses

LLPs are great for businesses that do not plan to raise funds. Professional services and family businesses often choose LLPs.

But when growth, funding, and scaling are the goal, LLPs feel limiting. This reality explains the private limited company vs LLP for investors debate clearly.

Future Growth Depends on Early Choice

Many businesses start small and think they will convert later. But structure change is not easy.

Choosing the right structure early saves time, money, and effort. If investors are part of your future plan, private limited companies are usually the safer choice. This is why private limited company vs LLP for investors is a decision that should not be rushed.

Risk and Legal Protection

Private limited companies offer strong legal protection. Liability is limited. Rules are clear.

Investors feel safer when laws protect their money. LLPs also offer limited liability, but enforcement and structure feel weaker to investors. Safety plays a big role in private limited company vs LLP for investors decisions.

What Corporate Seva Kendra Often Sees

Many businesses approach Corporate Seva Kendra after facing funding challenges. Often, the problem is structure.

Businesses registered as LLPs find it hard to attract investors. Those with private limited companies move faster in funding talks. This real-world experience supports the private limited company vs LLP for investors conclusion.

Final Thoughts

Choosing between a private limited company and an LLP is not just a legal decision. It is a growth decision.

For businesses aiming to attract investors, private limited companies offer better clarity, trust, and flexibility. LLPs are simple but limited. In the debate of private limited company vs LLP for investors, private limited companies usually win.

Making the right choice early helps businesses grow smoothly, attract funding, and build long-term success.